Enity Holding AB Announces Intention to List on Nasdaq Stockholm

Enity Holding AB (publ) (“Enity” or the “Company”), the largest specialist mortgage bank in Sweden, Norway, and Finland, today announces its intention to list its shares on Nasdaq Stockholm (the “Listing”), and publishes the prospectus and price per share for the Listing. In connection with the Listing, a distribution of shares is planned through an offering of existing shares (the “Offering”). The first day of trading is expected to be June 13, 2025. The Third Swedish National Pension Fund, Harry Klagsbrun via Harmar AB, Jofam AB, and Handelsbanken Fonder (collectively, the “Cornerstone Investors”) have, on the same terms as other investors, committed to acquire shares in the Offering for a total amount of SEK 625 million.

Summary of the Offering

- The price in the Offering is set at SEK 57 per share (the “Offer Price”), corresponding to a market value for all shares in Enity of SEK 2,850 million.

- The Offering consists of up to 25,500,000 existing shares, corresponding to approximately 51.0 percent of the total number of shares and votes in Enity (excluding the Over-allotment Option (defined below)), offered by Butterfly Holdco Pte Limited (the “Principal Shareholder”), which is indirectly controlled by EQT VII.

- To cover any over-allotment in connection with the Offering, the Principal Shareholder will issue an option to the Joint Bookrunners to acquire an additional maximum of 3,825,000 shares, corresponding to a maximum of 15 percent of the total number of shares in the Offering (the “Over-allotment Option”). Assuming the Over-allotment Option is exercised in full, the Offering will comprise up to 29,325,000 shares, corresponding to approximately 58.7 percent of the total number of shares and votes in Enity.

- Based on the Offer Price, the total value of the Offering amounts to approximately SEK 1,454 million (approximately SEK 1,672 million if the Over-allotment Option is exercised in full). The Company will not receive any proceeds from the sale of shares in the Offering.

- The Cornerstone Investors have, on the same terms as other investors, committed to acquire shares in the Offering for a total amount of SEK 625 million. These commitments represent a total of approximately 21.9 percent of the total number of shares and votes in Enity, and approximately 37.4 percent of the number of shares in the Offering, assuming the Offering is fully subscribed and the Over-allotment Option is exercised in full.

- Immediately after the completion of the Offering, assuming the Offering is fully subscribed and the Over-allotment Option is exercised in full, the Principal Shareholder will own approximately 41.4 percent of the total number of shares and votes in Enity.

- In connection with the Offering, the Principal Shareholder, the Company’s Board of Directors, and the executive management have committed to enter into customary lock-up undertakings, with certain exceptions as described in the prospectus. The lock-up period will be 180 calendar days for the Principal Shareholder and 360 calendar days for the Company’s Board of Directors and the executive management.

- The shares will be offered to the public in Sweden and Finland and to institutional investors in Sweden and in certain other jurisdictions in accordance with applicable rules and applicable exemptions.

- The application period for the public is expected to be June 9–12 at 3:00 PM 2025. The application period for institutional investors is expected to be June 9–12, 2025.

- The first day of trading on Nasdaq Stockholm is expected to be June 13, 2025, under the ticker symbol “ENITY”.

- A prospectus (in English, with a prospectus summary available in Swedish) containing the complete terms and conditions of the Offering has been published today on Enity’s website (www.enity.com) and can be accessed via Nordea’s website (www.nordea.se/prospekt), SEB’s website (www.sebgroup.com/prospectuses), ABG Sundal Collier’s website (www.abgsc.com), Nordnet’s website (www.nordnet.se and www.nordnet.fi) and Avanza’s website (www.avanza.se).

Björn Lander, CEO of Enity, comments:

“For over two decades, our ambition has been to make the housing market more accessible to those who often fall outside the traditional lenders’ systems. We specialize in helping borrowers with good future repayment capacity who are often overlooked by the major banks, including entrepreneurs and individuals with limited credit history. Through our regulated, fully secured lending model and scalable technology platform, we help a growing and underserved segment with care and responsibility. Today marks an important milestone in our journey, as we have the opportunity to expand the impact of our operations and welcome new shareholders to be part of our continued growth.”

Jayne Almond, Chairman of the Board of Enity, comments:

“Enity operates in a unique and growing niche in the mortgage market and has a business model that is both responsible and innovative. By focusing on fully secured mortgages, Enity has a low-risk profile, supported by a diversified funding base and a robust technology platform, creating a strong foundation for long-term growth and resilience. Under the leadership of Björn and a highly experienced management team, Enity has demonstrated the strength of its business model and is well-positioned to continue its successful development as a listed company.”

Vesa Koskinen, Partner at EQT, comments:

“Under EQT’s ownership, Enity has developed into a leading specialist mortgage bank in the Nordics. It is a strong company with a focus on a market with untapped potential, a modern technology platform, a diversified funding base, a fully secured lending model, and a strong presence in the Nordics. We are very pleased with the great interest that the financial market has shown in the IPO, including the support from several long-term, committed cornerstone investors and family offices, and welcome new shareholders to join EQT in this exciting journey.”

About Enity

Enity is a specialized mortgage bank operating in the Nordics, creating innovative and inclusive mortgage solutions for approximately 33,000 customers in Sweden, Norway, and Finland. Enity was established in 2005 with the aim of providing long-term access to the housing market for an unprioritized and rapidly growing segment of borrowers who are not always served by traditional major banks, despite low risk and strong potential. Since then, Enity has expanded its fully secured mortgage portfolio in Sweden and Norway, expanded to Finland, broadened its mortgage focus with a capital release product, and launched savings accounts in its product offering, completed the acquisition of Bank2 in Norway, and launched a covered bond program.

Enity serves its customers through a differentiated product range with three brands: Bluestep Bank in all its geographical areas, Bank2 in Norway, and 60plusbanken in Sweden.

Enity has made significant investments to develop a modern, scalable, and cloud-based operating model to become a truly digital specialist mortgage bank, while maintaining its low-risk profile and strong credit assessment expertise, paving the way for stable and profitable growth. Today, Enity is a profitable market leader based on the size of its mortgage portfolio, with lending to the public of SEK 29.3 billion as of March 31, 2025, in a steadily growing market with a low-risk portfolio consisting primarily of fully secured mortgages.

Strengths and Competitive Advantages

Enity is the largest player in secured specialist mortgages in the Nordics and operates in an unprioritized segment with high growth

Enity is the largest specialist mortgage bank in terms of outstanding loan portfolio in Sweden, Norway, and Finland. The Nordic mortgage market is expected to grow by approximately 2–4 percent per year to SEK 9,900 billion by 2027, while the specialist segment is estimated to grow by approximately 8–10 percent to approximately SEK 80–100 billion by 2027. Growth is driven by demographic changes, digitalization, and limited access to traditional mortgages. Enity’s market leadership, technical platform, and strong brands position the company well to take advantage of these trends and expand within its growing niche.

Sustainable and responsible offering for financial inclusion and enabling more people to take control of their finances

Enity promotes financial inclusion within underserved customer segments in the Nordics – such as people with modern forms of employment, the elderly, individuals with limited credit history, and individuals with payment defaults or existing debt – through tailored credit assessments, targeted products, and modern technology. By enabling homeownership, Enity contributes to reducing housing costs and generates, under certain assumptions, estimated savings of SEK 365,000 over three years compared to renting.

Using proprietary data, machine learning, and manual review, Enity builds its business on its ability to price credit risk with high precision while keeping credit losses low and stable. Enity offers inclusive mortgage solutions – which facilitate home purchases, refinancing, and debt consolidation – and strengthens the financial situation through capital release loans that provide pensioners with an average of over SEK 3,000 per month, while debt consolidation saves customers an average of SEK 15,000 per year.

Low and predictable credit losses thanks to a sophisticated and partially automated credit assessment model

Enity distinguishes itself through a credit assessment that balances automation with internal expertise built up over more than 20 years. The tailored process is based on a dynamic pricing matrix that takes into account factors such as source of income, loan-to-value ratio (LTV), loan amount, type of property, and interest rate, as well as existing debts. Automated data collection and risk assessment improve efficiency, accuracy, and customer satisfaction, while manual review ensures individually tailored decisions.

Supported by proprietary data since 2005, Enity’s data-driven credit assessment model delivers high asset quality, with an average credit loss ratio of approximately 0.17 percent between 2020 and 2024 – in line with selected Nordic major banks and significantly better than Nordic consumer banks offering unsecured loans. Enity’s low volatility in credit losses of 0.07 percent over the same period underscores the risk model’s consistency and reliability, compared to 0.12 percent for selected Nordic major banks and 0.42 percent for selected Nordic consumer banks. As of December 2024, Enity’s average weighted loan-to-value ratio was 67 percent, which strengthens the company’s resilience over business cycles.

Enity has established a diversified, cost-effective, and scalable funding model with a credit-rated covered bond program

Enity’s diversified funding platform includes deposits from private individuals, MTN programs, covered bonds, Tier 1 and Tier 2 capital instruments, and temporary credit facilities. Deposits – active since 2008 in Sweden, 2010 in Norway, and 2023 in Germany – provide flexibility through the ability to adjust interest rates. Enity also issues bonds under its MTN program and covered bonds under its Aa1-rated MTCN program, which was launched in 2020. With over 23 bond issues to date, of which 11 under the MTCN program, Enity is, to the Company’s knowledge, the only Nordic specialist mortgage bank with a covered bond program. This funding mix supports cost-effective growth, strengthens resilience, and reduces liquidity risk.

Digital mortgage bank: modern technology platform enables scalability and reduces operating costs

Since 2019, Enity has invested in a scalable, cloud-based platform to increase efficiency and support growth. Enity’s core banking system – implemented in Finland and used in the integration of Bank2 in Norway – manages the entire lifecycle of deposits and mortgages across three markets. In 2023, Enity launched an internally developed onboarding system that reduced the time from application to disbursement by approximately 20 percent in all markets during 2024 compared to 2022, with an expected reduction of approximately 75 percent as automation increases. This contributed to a 58 percent increase in annual loan volume per credit assessment employee and a decrease in Enity’s adjusted cost/income ratio during the three-month period ended March 31, 2025, compared to the same period in 2024, from 55.4 percent to 47.1 percent.

Experienced management team supported by industry experts

Over the past five years, Enity has optimized its organizational structure under an experienced and collaborative management team. CEO Björn Lander (appointed in 2019) and CFO Pontus Sardal (appointed in 2021) have extensive experience from the finance and technology sectors. The broader management team combines backgrounds in fintech and traditional banking. Under their leadership, Enity has reached several key milestones, including the transition to focusing solely on secured mortgages, the expansion to Finland, the launch of capital release products, the acquisition of Bank2 in Norway, the launch of the covered bond program (MTCN), the transition to a fully cloud-based IT platform, and the launch of the Enity brand.

Attractive financial profile with strong return on tangible equity, enabling both growth and dividend capacity

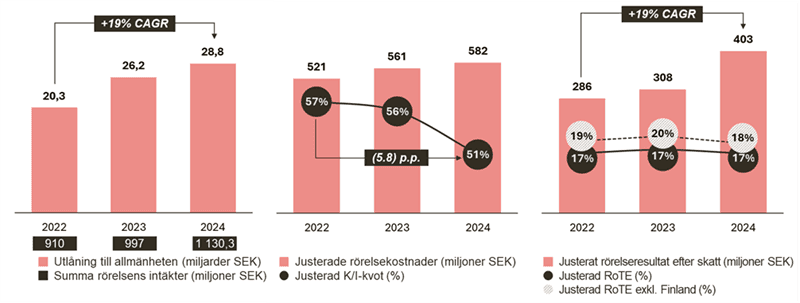

Enity has a strong financial profile, characterized by solid growth in the lending portfolio, scalable operations, and high returns. From 2022 to 2024, the adjusted sum of operating income increased with an annual average growth rate (CAGR) of 12 percent to SEK 1,131 million, driven by a 19 percent CAGR in lending to the public, from SEK 20 billion to SEK 29 billion, including the integration of Bank2. Operating efficiency improved during this period, with an adjusted cost/income ratio decreasing from 57.3 percent to 51.5 percent. Enity expects the adjusted cost/income ratio to decrease further to 40–42 percent in the medium term as a result of scalability and growth. Adjusted profit after tax increased from SEK 286 million to SEK 403 million (19 percent CAGR), with a recovery of 31 percent during 2024 after macroeconomic headwinds during 2023. Adjusted return on tangible equity (RoTE) was stable at 17 percent between 2022 and 2024 (19 percent excluding Finland), and Enity has a financial target to reach approximately 20 percent adjusted RoTE in the medium term. These results demonstrate Enity’s ability to deliver sustainable and profitable growth.

Selected Financial Information

The following table shows key figures for Enity:

| Million SEK (unless otherwise stated) | Fiscal year ended December 31 | Three-month period ended March 31 | |||

|---|---|---|---|---|---|

| 2024 | 2023 | 2022 | 2025 | 2024 | |

| Lending to the public | 28,832.4 | 26,205.1 | 20,346.3 | 29,310.0 | 27,308.6 |

| Total operating income | 1,130.3 | 997.0 | 910.0 | 301.7 | 275.1 |

| Adjusted operating profit | 507.4 | 388.4 | 360.4 | 127.8 | 109.9 |

| Adjusted profit after tax | 402.9 | 308.4 | 286.2 | 101.5 | 87.3 |

| Adjusted cost/income ratio | 51.5% | 56.2% | 57.3% | 47.1% | 55.4% |

| Credit loss ratio (%) | 0.16% | 0.24% | 0.15% | 0.22% | 0.23% |

| Adjusted RoTE (%) | 16.6% | 17.3% | 16.6% | 16.0% | 15.0% |

| Common Equity Tier 1 ratio (%) | 16.7% | 15.5% | 17.0% | 17.3% | 16.4% |

Financial Targets and Dividend Policy for Enity

On May 5, 2025, Enity announced the following financial targets and dividend policy:

- Annual organic lending growth of approximately 8–10 percent over a business cycle.

- A return on adjusted profit after tax in relation to average tangible equity (RoTE) of approximately 20 percent.

- A Common Equity Tier 1 ratio (CET1) that exceeds the regulatory requirement by 200–300 basis points.

A dividend policy with the objective of distributing approximately 20–40 percent of the year’s profit attributable to shareholders and any surplus capital (additional distributable funds), taking into account the target regarding the Common Equity Tier 1 ratio.

Background to the Listing and the Offering

The Board of Directors and the executive management of Enity, together with the Principal Shareholder, believe that the time is right for a listing of Enity. The Principal Shareholder will continue to have an ownership in the Company and actively participate in the work of the Board of Directors even after the Offering and the Listing and intends to continue to support Enity’s development going forward. Enity has established a solid platform and has further potential for future growth and improved results in the coming years. Furthermore, Enity’s Board of Directors and the executive management believe that an IPO will benefit Enity by giving the Company access to the Swedish and international capital markets, which is expected to promote Enity’s continued growth and development. The Company also believes that the listing of the shares on Nasdaq Stockholm will strengthen Enity’s public profile through increased brand awareness. The Board of Directors and the executive management, with the support of the Principal Shareholder, believe that the Offering and the Listing are a logical and important next step in Enity’s development.

Prospectus and Application

The Company has prepared a prospectus (in English, with a prospectus summary available in Swedish) in connection with the Offering and the Listing. The prospectus contains the complete terms and conditions of the Offering and is available on Enity’s website (www.enity.com) and can be accessed via Nordea’s website (www.nordea.se/prospekt), SEB’s website (www.sebgroup.com/prospectuses), ABG Sundal Collier’s website (www.abgsc.com), Nordnet’s website (www.nordnet.se and www.nordnet.fi) and Avanza’s website (www.avanza.se).

The prospectus has been prepared in accordance with the Prospectus Regulation (EU) 2017/1129 and has been approved by the Swedish Financial Supervisory Authority. The Swedish Financial Supervisory Authority’s approval of the prospectus should not be understood as an endorsement of the shares in the Company. Investors are advised to read the prospectus before making an investment decision, to fully understand the potential risks associated with a decision to invest in the shares (see “Risk factors” in the prospectus).

Expected Timetable

| Application period for the public | June 9–12 at 3:00 PM 2025 |

| Application period for institutional investors | June 9–12, 2025 |

| First day of trading of Enity’s shares | June 13, 2025 |

| Settlement date | June 17, 2025 |

Advisors

Nordea Bank Abp, branch in Sweden (“Nordea”) and Skandinaviska Enskilda Banken AB (“SEB”) are Joint Global Coordinators and Joint Bookrunners, and ABG Sundal Collier AB is Joint Bookrunner. Mannheimer Swartling Advokatbyrå AB is Enity’s and the Principal Shareholder’s legal advisor with respect to Swedish law, and Paul, Weiss, Rifkind, Wharton & Garrison LLP is Enity’s and the Principal Shareholder’s legal advisor with respect to U.S. law. Gernandt & Danielsson Advokatbyrå KB is legal advisor to the Joint Global Coordinators and Joint Bookrunners. Nordea, SEB, Nordnet and Avanza are Retail Distributors.

For more information, please contact:

Frida Malm, Fogel & Partners

+46 (0)76 239 4597

enity@fogelpartners.se

Juan Navas, Head of Communications, Enity Bank Group

+46 (0)70 306 2245

juan.navas@enity.com

The information was submitted for publication, through the agency of the contact persons set out above, at 10.30 CEST on June 9, 2025.

Enjoyed this post by Thibault Helle? Subscribe for more insights and updates straight from the source.