Easy Ways to Invest in Today’s Hottest Trends

Updated: May 27, 2025, 09:27 Published: May 27, 2025, 09:25

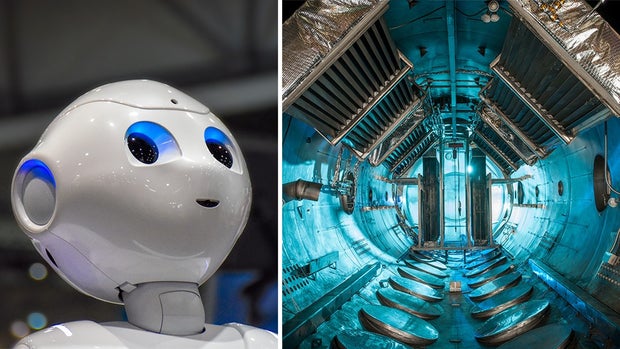

AI, green energy, cybersecurity, robots… Want to invest in some of today’s hottest trends, or perhaps choose a path on the stock market based on your own interests?

Discover exchange-traded funds – which have quickly become a popular way to invest in the Swedish market.

An exchange-traded fund, or ETF, is a fund that is traded on the stock exchange just like a stock. This means you can buy and sell shares in the fund during stock exchange opening hours, at the current market price.

This is an easy and flexible way to spread risks and at the same time follow the trends you believe in. You can invest in everything from global indexes to specific sectors or themes. There are ETFs for most things,

says Ara Mustafa, investment coach at Nordnet.

It could be an ETF for companies that will solve the environmental crisis, or for tech companies in India, companies that use AI… The possibilities are almost endless.

The selection is also constantly growing.

My tip is to start by thinking about which market or trend you believe in, and then use the filters to find the right ETF. Also, look at the fee, because it is important,

says Ara Mustafa.

Risk Diversification and Flexibility

Ara Mustafa believes that exchange-traded funds combine the best of both worlds; the risk diversification of funds and the flexibility of stocks.

ETFs have more one-off costs than regular funds, so buying and selling often does not become cheaper. In addition to management and exchange fees, which regular funds also have, there is a spread and brokerage. On the surface, it may therefore seem that regular funds are the cheaper alternative.

He explains that all fees when it comes to ETFs – except for the management fee – are one-off costs that are paid upon purchase and sale. The longer the savings horizon, the less important these become, while the ongoing management fee becomes increasingly important.

Therefore, it is often wise to look for low ongoing fees and that is what ETFs mostly offer.

Nordnet offers a commission-free monthly savings plan in ETFs. The minimum amount for monthly savings is 500 kronor per month, with the possibility to save in up to four ETFs with optional percentage capital allocation.

Ara Mustafa highlights another advantage of exchange-traded funds:

Something I think is good is that when you buy an ETF, you get the shares right away, since they are traded on the stock exchange. When buying a regular fund, it usually takes a day or two before you get the shares booked into your account, and if you buy a fund that is traded monthly or quarterly, it can take weeks and sometimes months.

Ara Mustafa states that ETFs can be a powerful tool for both beginners and experienced investors.

The important thing is to learn how they work and choose the ones that suit your own strategy and risk level.

Exchange-traded funds can be traded directly in Nordnet’s app or on the web. There it is also possible to filter and compare different ETFs.

At Nordnet Academy you can also read more about how ETFs work, about the opportunities but also the risks and challenges that exist. You should always do that when you invest,

says Ara Mustafa.

ETFs in Practice: Four Ways to Invest

- Base in the portfolio: A global or regional ETF can form the basis of long-term savings.

- Thematic investments: Invest in trends such as sustainability, technology, health or something else you believe in.

- Sector exposure: Get access to, for example, real estate, commodities or the financial sector.

- Currency diversification: Supplement Swedish holdings with ETFs in other currencies for good risk diversification.

TRENDY ETFs AMONG NORDNET’S CUSTOMERS RIGHT NOW

Defense:

- VanEck Defense ETF

- HANetf Future of Defence

- Global X Defence Tech

Clean energy:

- iShares Global Clean Energy

- Amundi MSCI new energy

- L&G Clean Energy

Robots:

- iShares Automation & Robotics

- Global X Robotics & Artificial Intelligence

- Amundi MSCI Robotics & AI ETF Acc

Artificial intelligence:

- Xtrackers Artificial Intelligence & Big Data

- WisdomTree Artificial Intelligence

- Global X Robotics & Artificial Intelligence

Cybersecurity:

- WisdomTree Cybersecurity

- L&G Cyber Security

- Rize Cybersecurity and Data Privacy

The ETFs in the list are based on statistics from Nordnet’s customer base and should not be regarded as an investment recommendation.

NORDNET – A MORE FUN SAVINGS IN STOCKS AND FUNDS

Nordnet is the Nordic region’s leading platform for savings. The bank was founded in 1996 with the aim of democratizing savings and investments.

Through inspiration and innovative services, Nordnet wants to make it fun and easy to save in stocks and funds. You open an account directly in the app and can start exploring your opportunities right away.

Historical returns are no guarantee of future returns. There is a risk that you will not get back the money you invested. Take part in the fund’s information brochure and fact sheet on Nordnet’s website before you invest.

This article is produced in collaboration with Nordnet.

Enjoyed this post by Thibault Helle? Subscribe for more insights and updates straight from the source.