Nvidia Soars on AI Boom Despite China Headwinds

The AI boom is lifting Nvidia (NVDA -0.51%), whose major customers like Meta, Google, Apple, Amazon, and Microsoft are expected to invest hundreds of billions of dollars in AI infrastructure this year.

For the fiscal year’s first quarter, Nvidia reported revenues of $44.06 billion – higher than the expected $43.29 billion. Data center revenues surged by 73 percent compared to the same period last year.

The adjusted earnings per share, which landed at $0.96, were also higher than the expected $0.93. The adjustment was due to costs related to export restrictions for the China-adapted H20 chip.

In early April, Nvidia announced that the U.S. export ban was expected to result in one-time costs for excess inventory and purchase commitments, after the Trump administration continued its predecessor’s export policy. In Wednesday’s report, the bill for the China problems came in at $4.5 billion, lower than the $5.5 billion they had accounted for in April.

Nvidia’s Results

First Quarter, Fiscal Year 2026 (figures in parentheses indicate difference compared to the same period last year)

- Revenue: $44.1 billion (+69 percent)

- Data Center Revenue: $39.1 billion (+73 percent)

- Gaming Revenue: $3.8 billion (+42 percent)

- Operating Income (GAAP): $21.6 billion (+28 percent)

- Gross Margin (Adjusted): 61.0 percent [71.3 percent excluding H20 cost] (-17.9 percentage points)

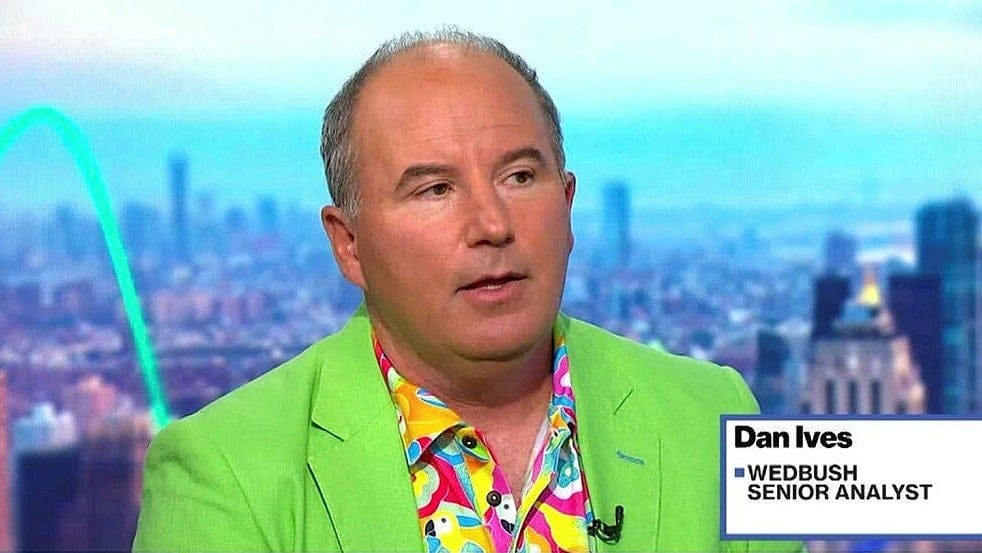

Wedbush analyst Dan Ives states that the company, despite the Chinese export ban, shows strong results during the quarter.

“If you take that into account – were it not for the H20 problems, the result would have been several billion dollars higher. It only confirms how strong everything is going. Overall, this is another masterpiece, especially given the headwinds the company faces in China driven by the Trump administration,” he says.

In Wednesday’s after-hours trading, Nvidia’s stock rose by as much as 5 percent, but then fell to 3.8 percent.

The company is guiding for revenues of approximately $45 billion in the second quarter, but that export restrictions continue to affect the business. The loss of H20 sales to China implies a revenue loss of around $8 billion.

At the same time, Nvidia is developing a chip that will comply with U.S. export regulations, but also communicates a caveat: there is a risk that export licenses will not be granted.

According to investment bank Oppenheimer, the long-term China effect is limited as the country now only accounts for 5 percent of the company’s sales.

On Wall Street, some analysts warn that Nvidia’s high valuation leaves little room for disappointment and that declines could be amplified if expectations are not met.

But it is the bright outlook that dominates: 87 percent of analysts have a buy recommendation on the stock. In a client letter, analyst Harsh Kumar at investment bank Piper Sandler admits that there are uncertainties surrounding China but urges investors to “endure the uncertainty and maintain their positions.” He also calls the current challenges likely the last major negative wave for the year.

But in the longer term, how long can Nvidia’s progress continue? Dan Ives, who is well known for his very positive view of the AI sector, believes that the chip giant still has a unique advantage:

“There is only one chip in the world for the AI revolution.”

Enjoyed this post by Thibault Helle? Subscribe for more insights and updates straight from the source.