UK Identifies Billions in Unreported Assets, Doubles Previous Year’s Figures

The UK government has identified £1.5 billion (€1.8 billion) in unreported assets for the fiscal year 2023-2024, more than double the previous year, according to figures obtained in June by law firm Pinsent Masons. This amount includes £652 million paid by former Formula 1 boss Bernie Ecclestone, convicted in 2023 for failing to declare over £400 million held in a trust in Singapore.

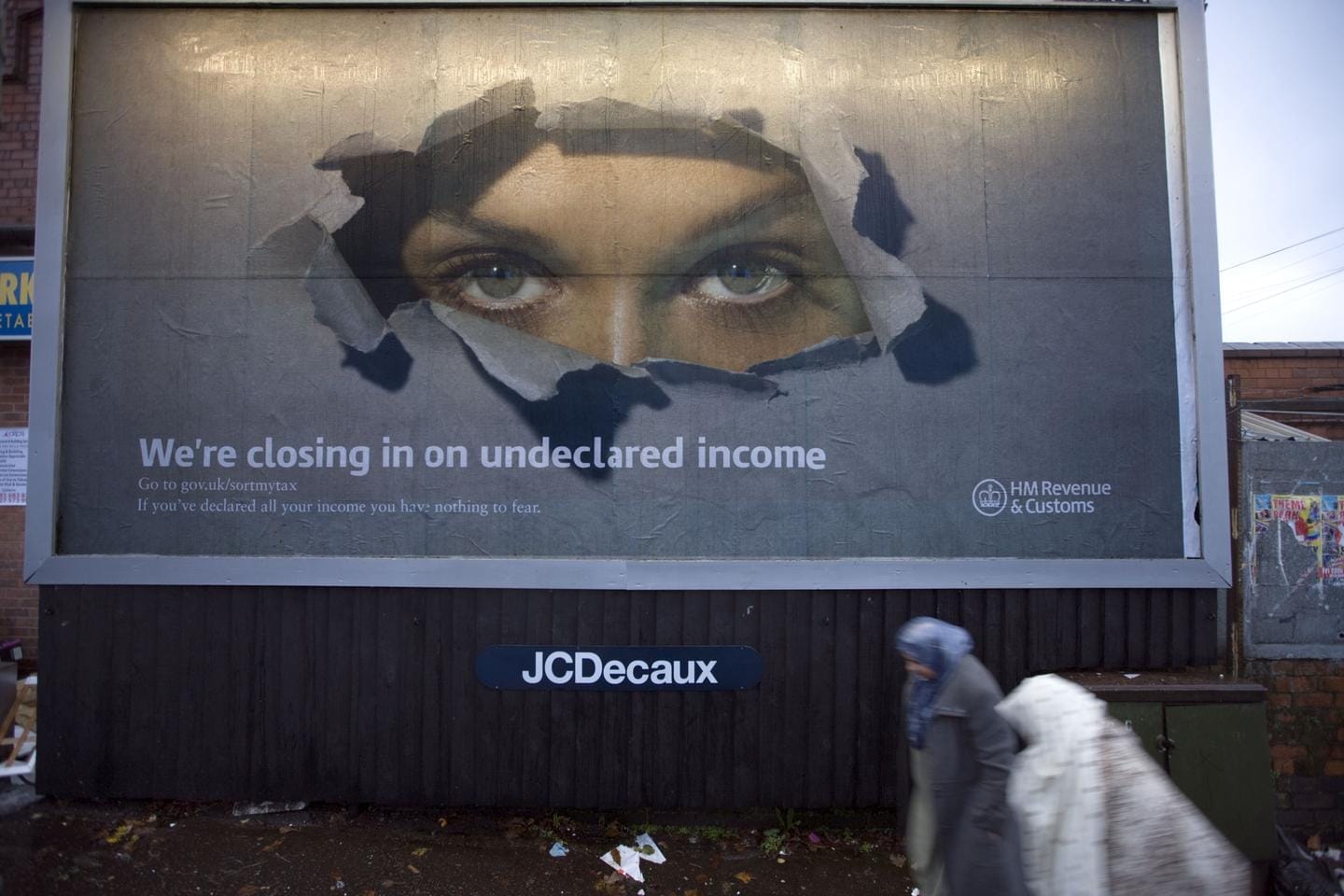

The funds withheld from tax were identified by a special unit within HM Revenue and Customs (HMRC), which focuses on wealthy taxpayers and medium-sized businesses. “The government is determined to close the gap caused by tax evasion, in order to redress state finances without having to raise taxes,” emphasizes Fiona Fernie, a partner at tax advisory firm Blick Rothenberg. In 2022-2023, the cost of tax evasion amounted to £39.8 billion, according to HMRC.

Investigators in charge of tracking down fraudsters relied on a tool called Connect, based on artificial intelligence. Capable of comparing 55 billion data points contained in more than 30 databases, it “identifies hidden connections between individuals and certain assets or sources of income,” she specifies.

Enjoyed this post by Thibault Helle? Subscribe for more insights and updates straight from the source.